Today, we’re going to talk about a topic that might surprise you – the Morningstar Ratings Myth. If you’re an investor, chances are you’ve used or at least heard of Morningstar Ratings. These-star ratings have become a kind of shorthand for investors worldwide, serving as quick evaluative benchmarks for mutual funds and Exchange-Traded Funds (ETFs). Many investors perceive them as a seal of quality or disapproval. However, is their value as definitive as commonly perceived? This piece aims to demystify the so-called ‘Morningstar Ratings Myth.’

Understanding Morningstar Ratings

Morningstar Ratings have earned their place in the financial world as they provide a simplified, quantifiable tool to assess a fund’s historical performance. How do they do this? By rating funds on a scale from one to five stars, Morningstar measures a fund’s past risk and return. The algorithm rewards funds that have demonstrated consistent performance over time and penalizes those with more significant volatility.

This mechanism offers a particular appeal – a simple numeric measure that allows investors to sift through the overwhelming universe of funds swiftly. However, despite its apparent simplicity, it’s essential to avoid misconceptions. Investors should resist the temptation to treat these ratings as an all-seeing crystal ball. Indeed, Morningstar Ratings can offer insightful guidance, serving as a beneficial starting point. Nevertheless, they do not serve as an infallible predictor of future performance.

The Morningstar Ratings Myth

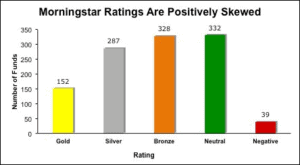

Now, let’s delve into the heart of the matter – the ‘Morningstar Ratings Myth.’ This myth revolves around a widely held belief that higher-rated funds invariably outperform their lower-rated counterparts. However, data, experience, and Morningstar themselves have shown that this isn’t always the case.

Morningstar acknowledges that its star ratings offer a modestly useful tool to measure past performance but fall short of being an authoritative guide for future performance. Let’s consider a hypothetical scenario. A five-star-rated fund, despite its high standing, underperforms the market, while a less-glamorous three-star-rated fund from the same category significantly outpaces its lofty expectations. The key takeaway here is to understand that past performance, although useful, isn’t always a crystal-clear predictor of future results.

As we peel back the layers of the Morningstar Ratings myth, we’re faced with a reality that many investors find disconcerting. The reliance on a simplistic numeric system to navigate the labyrinthine that is the world of investment is a seductive one. However, this reliance can become an Achilles heel for investors, particularly those who stake their investments solely on star ratings.

Understanding the Basis of Morningstar Ratings

The process of awarding star ratings involves a sophisticated algorithm that takes into account a fund’s risk-adjusted returns over three, five, and ten-year periods. The better a fund’s risk-adjusted return, the higher its Morningstar rating. This approach to rating is beneficial because it puts the focus on both risk and reward. However, as prudent investors will tell you, risk management does not end with past performance analysis.

The tendency to interpret these star ratings as an endorsement of future performance underscores the Morningstar Ratings myth. It is an oversimplification that overlooks the multitude of factors that influence the investment landscape.

The Limitations of Morningstar Ratings

One of the fundamental limitations of Morningstar Ratings is their inherent backward-looking nature. They are exclusively grounded in past performance. While this provides a beneficial look into a fund’s historical behavior, it doesn’t afford a comprehensive forecast of a fund’s potential.

Indeed, numerous factors can influence a fund’s future performance that Morningstar Ratings don’t directly account for. Consider changes in the fund’s management team, which might introduce different investing styles and strategies, or shifts in the broader economic environment that might significantly impact the fund’s performance. Furthermore, alterations in the fund’s investment strategy can also dramatically affect future performance.

Moreover, it’s crucial to be aware of the “survivorship bias” that influences Morningstar Ratings. Since these ratings only include funds that have survived the period analyzed, they potentially overstate the performance of surviving funds and disregard the many funds that may have been liquidated or merged due to poor performance.

An All-Encompassing Approach to Investment Decisions

Given the limitations of Morningstar Ratings, it is crucial for investors to employ a comprehensive approach to investment decisions. Start with a clear understanding of your financial goals and risk tolerance. Analyze the fund’s history, not only its rating but also its manager’s track record and performance during different market conditions.

Next, dive into the fund’s prospectus and evaluate its investment strategy. Look at its holdings, geographical distribution, and sector allocation. A well-diversified fund could provide a buffer in volatile market situations.

Also, don’t overlook fees. High expense ratios can significantly impact your returns, particularly in the long run. Compare the fund’s fees with those of similar funds to ensure you are not overpaying for performance.

All this could sound overwhelming, but we can provide guidance during this comprehensive evaluation process. We offer personalized advice that takes into account your investment goals, risk tolerance, time horizon, and other financial circumstances.

The Role of Investor Education

Investor education plays a significant role in debunking the Morningstar Ratings Myth. Investors need to understand the parameters that Morningstar Ratings cover and the ones they don’t. Comprehensive knowledge of financial markets and understanding the inherent risk associated with investing can prevent misconceptions that might lead to sub-optimal investment decisions.

Furthermore, investors should be equipped to understand and interpret various financial statements and reports. Not only do these reports contain crucial information regarding a company’s financial health, but they also often include forward-looking statements that can provide useful insights into a company’s future expectations.

Final Thoughts

In conclusion, while Morningstar Ratings can serve as a beneficial tool for initial fund selection, they should not be used in isolation. The ‘Morningstar Rating Myth’ acts as an important reminder that investment decisions should not be based solely on past performance or a simplified numeric system.

Investing requires a nuanced, comprehensive, and forward-looking approach. And as such, a well-rounded strategy that includes a detailed understanding of your investment goals, risk tolerance, and a broad evaluation of different factors influencing an investment’s potential, can pave the way for long-term financial success.

Remember, your financial journey is personal. It deserves an investment plan that is as comprehensive, diversified, and adaptive as the financial markets themselves.

If you have any questions give us a call!

Have a great weekend!

Source: Ballentine Capital Advisors

Golf Tip of the Week

British Open 2023: Pro Reveals The Golf Tee Tactic That Helped Him Make A Hole-In-One

HOYLAKE, England — The 17th hole was probably the last one Travis Smyth wanted to play when he stepped onto the tee of it Friday morning, 10-over par for the tournament.

The green is shaped like a turtle’s shell. It’s uphill, and the wind was gusting. An unlikely set of conditions for the little-known Asian Tour player who was previously best known for playing in the LIV Tour’s inaugural event, to send his ball directly into the hole. His name will go down as the first ace in the history of Royal Liverpool Golf Club’s newly-redesigned 17th hole, which has sparked controversy for its difficulty all week.

The hole, playing just a hair shy of 140 yards, was just a soft 9-iron for Smyth.

“I chipped it,” he said.

But the secret to the shot that let out the loudest roar of the day wasn’t in the club or ball, but in the golf tee that propped it up.

With a high-lofted club into the wind, teeing up your ball may seem like an unusual move. But Smyth says it’s an essential one that the rest of us can learn from.

Teeing up the ball does make the ball go slightly higher, but it also helps the ball come off with lower backspin. Less backspin makes the ball more immune to wind.

“The club has less interaction with the ground,” he says. “When you’re trying to hit a low one, you are coming in quite steep. It’s easier off a tee, so you’re not catching the ground instantly at impact, which will create spin, which into the wind you don’t want to do.”

So that’s been the tactic for pros all week, including Smyth: Tee the ball about half an inch off the ground, and swing soft. The softer swing keeps the ball lower and, in addition to the tee, sends the ball through the air with very little spin. The perfect shot for into wind.“

Some tee it quite high, higher than you think, when they want to hit low ones,” he says. “It’s all about that spin.”

A helpful piece of advice to remember in the gusts, though Smyth says he can’t guarantee the same results he enjoyed on Friday.

Is it the British Open or the Open Championship? The name of the final men’s major of the golf season is a subject of continued discussion. The event’s official name, as explained in this op-ed by former R&A chairman Ian Pattinson, is the Open Championship. But since many United States golf fans continue to refer to it as the British Open, and search news around the event accordingly, Golf Digest continues to utilize both names in its coverage.

Tip adapted from golfdigest.comi

Recipe of the Week

Almost-Famous Guacamole

6 Servings

Ingredients

- 3 ripe avocados

- 2 teaspoons fresh lemon juice

- 2 teaspoons fresh lime juice

- Kosher salt

- 2 tablespoons chopped fresh cilantro

- 2 tablespoons finely chopped red onion

- 1 to 2 teaspoons finely chopped seeded jalapeno (see Cook’s Note)

Instructions

- Mash together the avocado, lemon juice, lime juice, and 1 1/2 teaspoons salt in a mixing bowl until creamy. Fold in the cilantro, red onion, and jalapeno with a spoon or spatula. Adjust the salt if needed.

- The guacamole can be made up to 2 hours in advance. Store in an airtight container and smooth a sheet of plastic wrap on the surface without any air pockets. Refrigerate until ready to serve.

Cook’s Note

- Jalapenos have varying degrees of heat. It is best to try a small piece of jalapeno to determine the spice level, then add according to your preference

Recipe adapted from Foodnetwork.comii

Health Tip of the Week

Simple Steps To Boost Bone Health

Strong Bones For Life

Weak and brittle bones don’t have to be part of aging. Your bones are a living tissue that rebuilds itself. Your bone mass reaches its peak between your mid-20s and mid-30s. You can “borrow” from that banked strength as you get older. Here’s how to get, and keep, your bones dense at any age.

Calcium: Why You Need It

If you’re like most Americans, you probably don’t get enough of this mineral to keep your bones healthy. Calcium makes your bones hard and dense. If your calcium levels are too low, your body takes it from your bones. Too much loss may lead to osteoporosis or brittle bone disease. That raises your chances of falls and broken bones.

Calcium: How to Get It

Starting around age 50, you need about 1,200 milligrams of calcium a day to stop bone loss. But you should get even more, 1,300 milligrams daily, between ages 9 to 18 to stock up for adulthood. Good food sources include:

- 1 cup plain low-fat yogurt (300 milligrams)

- 1/2 cup firm tofu with calcium (200 milligrams)

- 1 cup baked beans (140 milligrams)

- 3 ounces canned salmon with edible bones (180 milligrams)

Vitamin D: Why You Need It

It works in tandem with calcium. Without vitamin D, you can’t absorb the calcium from foods. That forces your body to raid your skeleton for the nutrient. That weakens your bones. It also prevents your body from building strong new bones. A blood test can tell you your levels. The normal vitamin D level for adults is equal to or greater than 20 ng/mL. Less than 12 ng/mL means you’re vitamin D deficient.

Vitamin D: How to Get It

Your skin makes vitamin D from sunlight. Just a few minutes of sun each day should do it. The second way is through foods. Good sources include:

- Fatty fish like salmon, tuna, or mackerel

- Fortified milk from cows, almonds, soy, and oats

- Eggs

- Pork

- Fortified cereal

Supplements might help. But talk to your doctor first. Too much could be harmful.

Get Physical Every Day

When you exercise regularly, your body responds by adding more bone. Adults who work out can help prevent the bone loss that usually starts in their 30s. Bonus: Exercise builds muscles, which help improve your balance and coordination. So you may be less likely to fall in the first place.

Best Exercises to Build Bones

Weight-bearing activities. You work against gravity by:

- Running

- Walking

- Dancing

- Climbing stairs

These exercises are site-specific. So jogging may strengthen the bones in your legs and feet, but not your arms.

Resistance exercise. This is also called strength training. It taxes your bones so they can grow heavier and denser. Try:

- Pushups

- Free weights

- Rowing

- Resistance bands

Aim for at least 30 minutes of any type of exercise each day.

Quit Smoking

Nearly 1 in 7 American adults smoke. It’s a known risk factor for osteoporosis. Nicotine and other chemicals in tobacco slow the production of bone-forming cells. They also hinder blood flow to your bones. The result is frail bones that are more apt to break. That can be a concern, especially in your spine, which already doesn’t get much blood.

Cut Out Added Sugar

Your body does not need any added sugar from soft drinks, cookies, and other processed foods. Too much-added sugar may hurt your bone health because of it:

- Causes your body to flush out bone-strengthening calcium and magnesium in your pee

- Prevents your intestines from taking in enough calcium

- Displaces important nutrients from your diet

Limit Alcohol

Heavy drinking can lead to more falls. It also makes your bones easier to break by interfering with bone-growth cells called osteoblasts. Heavy drinking means 15 drinks or more per week for men and eight drinks or more for women. A drink is 12 ounces of beer, 5 ounces of wine, or 1.5 ounces of vodka, whiskey, and other hard liquor. It’s unclear if moderate drinking (one or fewer drinks daily for women and two or fewer for men) helps or hurts your bone health.

Tip adapted from WebMD.comiii

Copyright (C) 2021. Ballentine Capital Advisors. All rights reserved.

Our mailing address is:

Ballentine Capital Advisors

15 Halton Green Way

Greenville, SC 29607

unsubscribe from this list update subscription preferences

Disclosure:

Ballentine Capital Advisors is a registered investment adviser. The advisory services of Ballentine Capital Advisors are not made available in any jurisdiction in which Ballentine Capital Advisors is not registered or is otherwise exempt from registration.

Please review Ballentine Capital Advisors Disclosure Brochure for a complete explanation of fees. Investing involves risks. Investments are not guaranteed and may lose value.

This material is prepared by Ballentine Capital Advisors for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation or any particular security, strategy, or investment product.

No representation is being made that any account will or is likely to achieve future profits or losses similar to those shown. You should not assume that investment decisions we make in the future will be profitable or equal the investment performance of the past. Past performance does not indicate future results.

Advisory services through Ballentine Capital Advisors, Inc.

i https://www.golfdigest.com/story/british-open-2023-17th-hole-in-one-golf-tee-par-3

ii https://www.foodnetwork.com/recipes/food-network-kitchen/almost-famous-guacamole-11309840

iii https://www.webmd.com/osteoporosis/ss/slideshow-boost-bone-health