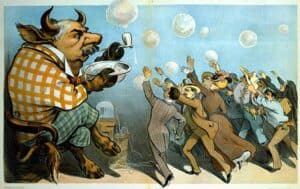

Welcome to a time-traveling journey back to the Roaring 20s – a decade that symbolizes the epitome of “The Madness of Crowds.” This decade serves as a case study in how the overwhelming enthusiasm of the masses – both socially and economically – can set the stage for unexpected, and often devastating, outcomes.

What Made the ’20s Roar?

The 1920s were nothing short of transformative for the American economy. Not only did the nation witness a surge in income, but there was also a broad expansion of the middle class. Many factors contributed to this, but two sectors stood out: the automobile industry and consumer goods. Cars, once a luxury item, became accessible to average families, thanks in part to Henry Ford’s assembly line innovation. Likewise, consumer goods like refrigerators and washing machines started finding their way into homes, changing the lifestyle of millions.

The stock market also played a critical role in shaping the decade. It wasn’t just a playground for the wealthy; now, the middle class saw it as a pathway to quick riches. With the bull market offering high returns, many dabbled in stock trading, often buying on margin. This fervor to be part of the booming market would later have consequences, but for the time being, it only added fuel to the economic fire.

But the decade didn’t just roar in dollars and cents; it roared in breaking boundaries and societal norms. First on the list was women’s suffrage. The 19th Amendment in 1920 gave women the right to vote, setting the stage for more gender equality and changes in traditional gender roles.

The Collective Mania

The stock market became a national obsession during the ’20s. The ‘get-rich-quick’ mentality drew in people from all walks of life. Barbers, taxi drivers, and clerks talked about stocks as though they were experts, even though many barely understood market fundamentals. Everyone seemed to believe the market was a one-way ticket to prosperity.

However, the grim reality was that many of these amateur investors were playing with fire. Many traded on margin, essentially borrowing money to buy more stocks. In their blind faith in the market’s upward trajectory, people overlooked the risks. They invested their life savings, and in some cases, even mortgaged their homes to buy stocks. This speculative bubble grew larger and more unstable as the decade progressed.

The Flapper Culture

The ’20s also gave birth to the Flapper, an icon of modern womanhood. These women rejected traditional Victorian norms; they bobbed their hair, raised their hemlines, and some even took up smoking – a behavior previously associated only with men. They drank and partied, relishing their newfound freedom.

Flapper culture wasn’t confined to a small group; it spread like wildfire, thanks in part to mass media. Films and magazines glorified the flapper lifestyle, making it aspirational for young women across the nation. This societal change and the stock market frenzy fed off each other, together creating a heady cocktail of reckless optimism and boundless opportunity – precisely the kind of collective mania that defines the madness of crowds.

The Warning Signs

The surface-level prosperity of the ’20s concealed deep economic fissures that were widening by the day. One of the most glaring issues was the extreme inequality in the distribution of wealth and income. The richest 1% owned a disproportionate share of the nation’s wealth, while the majority of Americans lived paycheck to paycheck. This imbalance was unsustainable and signaled an economy built on shaky ground.

Moreover, the age was marked by a credit boom, both in consumer spending and in the financial markets. People were buying cars, homes, and stocks largely on credit. This rampant use of borrowed money created a house of cards. The economy seemed to be growing, but much of that growth was fueled by debt rather than genuine productivity or innovation. The facade of perpetual growth was compelling but ultimately deceptive.

The social landscape was equally fraught. The era of Prohibition not only failed to prevent alcohol consumption but also gave rise to a new set of problems: organized crime and illegal speakeasies became part of the American fabric.

The Bubble Bursts

Black Tuesday shattered the illusion of endless prosperity. On October 29, 1929, the stock market imploded, erasing fortunes overnight. It was the cataclysmic end to a decade fueled by speculative frenzy and overconfidence. Millions of Americans who had poured their life savings into the stock market were left penniless. This devastating event didn’t just mark the end of an era; it was the beginning of the Great Depression.

The cultural euphoria of the ’20s didn’t survive the stock market crash. The hardship of the Great Depression imposed a sobering effect on the American psyche. Social morals and standards tightened as people returned to more traditional values, perhaps as a form of collective self-preservation during challenging times.

Lessons Learned

In the wake of the financial calamity, sweeping regulatory reforms were enacted. The Glass-Steagall Act of 1933 was one such regulation that aimed to separate commercial banking from investment banking, thus reducing the risks associated with speculative trading. The creation of the Securities and Exchange Commission (SEC) followed, providing oversight to the stock market. These changes aimed to prevent another meltdown and restore public confidence in the financial system.

The Roaring ’20s taught a hard lesson about the perils of unchecked optimism and speculative mania. The hard years of the Great Depression instilled a sense of caution and responsibility in a generation that would carry those values forward. The reckless abandon of the ’20s was replaced by a more prudent and cautious approach to both economic opportunities and social norms, lessons that were passed onto future generations.

Conclusion

The Roaring ’20s serve as a vivid case study in the madness of crowds. The decade experienced unparalleled highs but also catastrophic lows, all stemming from the collective mania that gripped society. So, as you navigate through our current decade, it’s worth pondering – could we be in the throes of a new form of collective mania? Stay aware, stay informed, and most importantly, don’t get lost in the crowd.

Have a great weekend!

Source: Ballentine Capital Advisors

Golf Tip of the Week

A ‘Preferred Miss’ Will Lower Your Stress And Scores. Here’s How To Find Yours

One of the problems with playing Army Golf—where your misses go in every direction, left, right, left, right—is the mental side can be left crippled with doubt. Trouble up the left side? Logically, you’d think you should aim up the right, but if you miss that way, you’re suddenly miles away in the next fairway.

Everyone knows where their good shots are going—at whatever target they choose—but knowing where your bad shots will go is critical to scoring, especially when you’re not hitting the ball well. That’s the topic me and Golf Digest Senior Game Improvement Editor Luke Kerr-Dineen talked about on this episode of Golf IQ.

Circling back to our example of trouble up the left side, if you know that your typical miss is to the right (and rarely left), then you can aim up the left side of the fairway and be confident that your worst shot will only go a little bit into the right rough. If you tend to miss left—and hardly ever blow it out to the right—then you can aim up the right edge of the fairway, and your worst miss will still avoid the trouble on the left.

OK, this all sounds too simple. How do you get a one-way miss? They key is to get all your shots moving in the same direction, either left-to-right or right-to-left. Once you groove one shot shape, your bad shots will simply be more extreme versions of what your ideal shot shape is. Deciding on which shot shape you want starts with figuring out which miss you want to avoid.

Preferred miss

Most of us have one shot that we despise hitting. For some, it’s a quick hook, while for others (like Lucas Glover), it’s a shot that starts right and goes farther right. Once you decide which bad shot you’d like to never (or rarely) hit, then the opposite direction will be your preferred miss. This is the shot that, though you don’t like hitting it, you’re OK with the outcome. It doesn’t ruin your confidence.

Next, you’ll pick a shot shape that, when it curves too much, will be your preferred miss. If a right-handed player decides their preferred miss is to the left, then they’ll make sure they are drawing all their shots. When they overdo the draw, they will miss left, but rarely will they miss right. The same goes for a righty who hates the left miss—they should hit fades to ensure their misses go to the right.

Having this one-way, preferred miss will free you up and allow you to pick targets that minimize risk. That’s how you’ll score even when you’re not hitting it well.

Tip adapted from golfdigest.comi

Recipe of the Week

Chicken And Tater Tot Casserole

4 Servings

Ingredients

- 4 tablespoons unsalted butter

- 2 carrots, cut into 1/2-inch thick rounds

- 2 stalks celery, cut into 1/4-inch half-moons

- 1 onion, chopped

- Kosher salt and freshly ground black pepper

- 1/4 cup all-purpose flour

- 2 cups chicken broth

- 1 cup whole milk

- 4 cups shredded cooked chicken

- 3 cups frozen tater tots, thawed

- 1 teaspoon fresh thyme leaves

Instructions

- Preheat the oven to 450 degrees F.

- Melt the butter in a large heavy pot over medium-high heat until hot. Add the carrots, celery and onions and season with 1 teaspoon salt and 3/4 teaspoon pepper. Cook, stirring occasionally, until the vegetables are golden, about 12 minutes. Stir in the flour, and then whisk in the broth and milk and bring to a boil, whisking. Boil until slightly thickened, about 3 minutes. Stir in the chicken. Transfer to a 2-quart baking dish.

- Pulse the tots in a food processor with the thyme until medium ground. Scatter over the top of the casserole and bake until the filling is bubbling and the topping is golden and crisp, 20 to 25 minutes. Let stand 10 minutes before serving.

Recipe adapted from Foodnetwork.comii

Health Tip of the Week

Are You Making Your Dry Eyes Worse?

If your eyes feel dry and gritty or water a lot, you no doubt want quick relief.

Whether your dry eye is painful or just a little irritating, it can get in the way of things you want to do. You may find it hard to read, watch TV, or work on the computer. And being on an airplane or anywhere with dry air is uncomfortable.

Your tears have an important job. Every time you blink, they spread across the front of your eye. That keeps the surface wet, washes away dirt and other things, and lowers your odds of infection.

Still, there are a lot of reasons your eyes dry out. It’s a common problem, especially as you age.

You can do a lot to help your dry eyes feel better. That includes using a warm compress on your eyelids and gently massaging them. But you could be doing things that aren’t helping and not even know it:

Make sure you don’t:

- Use the wrong kind of eye drops. Artificial tears replace the ones your eyes aren’t making. And they do help relieve some of the discomfort of dry eyes. But some are better than others.Stay away from the ones that promise to get rid of redness. They have chemicals that shrink the blood vessels in your eyes.They can make dry eye worse. Some people are also sensitive to certain preservatives in different eye drops.Your doctor can tell you which drops are right for your eyes.

- Smoke. Cigarettes don’t just hurt your lungs, they’re also bad for your eyes. Smoking or being around smoke can make your eyes burn, sting, and feel scratchy.

- Take allergy meds: They dry up your tears, which makes it harder for your eyes to wash out allergens.

- Go outside without shades. Your dry eyes need protection from the wind and sun. Choose sunglasses (or glasses if you wear them) that fit close to your face and have side frames.Wear them all the time, not just when it’s sunny.

- Look at the screen too long. Your eyes need a break. Practice the 20/20/20 rule. Take a 20-second break every 20 minutes and look at something 20 feet away. Make sure your monitor is in the right place. It should be at or just below eye level so you don’t strain your eyes.

- Not blink enough. Blink more often when you’re on the computer, reading, driving, or watching television. You blink less when you’re focused on something. Blinking is good for your eyes. It spreads your tears smoothly across them.

- Wear eye makeup. Mascara and eyeliner can block the glands in your eyelids that make tears. That can cause pain and swelling. Wearing eyeliner along the inside of your eyelids is never a good idea. It can block the glands and get bacteria in your eye.

- Skimp on liquids. Your eyes can dry out if you don’t drink enough water. Try for 8 to 10 glasses a day. If you have a hard time drinking that much, opt for foods with a high liquid content like watermelon, lettuce, and tomatoes.

- Eat poorly. Oily fish like salmon, nuts, and leafy greens are all high in omega-3 fatty acids, which can help with dry eye.Try to eat at least two servings of fish a week. Flaxseed oil and fish oil are also good sources of omega-3s.

- Hang out in dry air. Use a humidifier to moisten the air in your home. You can also open windows for a few minutes on cold days and longer in spring and summer to help keep air moist. If you live or work somewhere with a lot of dust, consider using an air filter.

- Self-treat without talking to your doctor. It may be tempting to buy tear drops or ointments at your local pharmacy. But you’ll be better off getting expert help first.A lot of things can cause dry eye. Your doctor can find out why it’s happening to you and tell you the best things to do to make it better.

Tip adapted from WebMD.comiii

Copyright (C) 2021. Ballentine Capital Advisors. All rights reserved.

Our mailing address is:

Ballentine Capital Advisors

15 Halton Green Way

Greenville, SC 29607

unsubscribe from this list update subscription preferences

Disclosure:

Ballentine Capital Advisors is a registered investment adviser. The advisory services of Ballentine Capital Advisors are not made available in any jurisdiction in which Ballentine Capital Advisors is not registered or is otherwise exempt from registration.

Please review Ballentine Capital Advisors Disclosure Brochure for a complete explanation of fees. Investing involves risks. Investments are not guaranteed and may lose value.

This material is prepared by Ballentine Capital Advisors for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation or any particular security, strategy, or investment product.

No representation is being made that any account will or is likely to achieve future profits or losses similar to those shown. You should not assume that investment decisions we make in the future will be profitable or equal the investment performance of the past. Past performance does not indicate future results.

Advisory services through Ballentine Capital Advisors, Inc.

i https://www.golfdigest.com/story/preferred-miss-one-way-miss-scoring-golfiq

ii https://www.foodnetwork.com/recipes/food-network-kitchen/chicken-and-tater-tot-casserole-2268655

iii https://www.webmd.com/eye-health/make-dry-eyes-worse