“The Madness of Crowds” is a phrase coined centuries ago that aptly describes the collective rush of people into seemingly irrational behaviors, often resulting in spectacular crashes. Financial markets are a prime playground for this kind of madness. The South Sea Crash and Tulip Mania are two of the most iconic episodes of mass speculation in financial history. In this newsletter, we’ll embark on a journey through time, visiting the bustling markets of 17th-century Netherlands and early 18th-century Britain, where fortunes were made and lost on tulips and company stocks.

Setting the Scene: The Economics of the Early Modern Period

The 17th-century Netherlands and 18th-century Britain were periods of burgeoning trade and growing national debts. In the 17th century, the Dutch Republic was an undisputed maritime and economic powerhouse. Its vast trading network, facilitated by the Dutch East India Company and West India Company, spanned from the spice-laden islands of Southeast Asia to the sugar plantations of the Americas. Meanwhile, in the early 18th century, Britain was asserting itself as a dominant force in global trade and colonization. The countries’ forays into global trade were marked by overseas ventures, commercial rivalries, and the birth of modern capitalism. During this time, joint-stock companies and financial markets emerged as entities that allowed the pooling of capital for large projects, giving birth to the stock market as we know it.

Tulip Mania: The Flower That Drove a Nation Wild

The tulip, new to Europe and boasting stunning, vibrant colors, quickly became a luxury item for the Dutch elite. Amidst booming trade, the Dutch Republic was prosperous, and the middle class had money to spend. Futures contracts and frenzied auction houses turned flowers into golden opportunities—for a time. At its height, a single tulip bulb was worth a skilled worker’s yearly wage. Then, almost overnight, prices plummeted, leading to broken contracts, ruined fortunes, and a more cautious financial environment. The mania serves as a cautionary tale of how something as simple as a flower can unveil the precariousness of an entire economy under the spell of speculation.

The South Sea Crash: Britain’s Bubble Burst

The South Sea Company, originally a trading company with a monopoly on British trade in the South Seas, became more focused on its role as a financial contractor to the government. The British Crown, deeply in debt, became heavily involved in the company. Share prices soared based on grandiose promises of untold riches from trade. Flamboyant advertising and rampant rumors fueled the fire. Eventually, the company could not sustain the bubble, and the stock collapsed, dragging down the fortunes of many with it. This disaster exposed the dangers of intertwining speculative companies with government interests and remains a stark warning for modern economies.

Common Themes and Psychological Factors

In both cases, people from all walks of life threw their savings into the speculative frenzy, exhibiting mass speculation and irrational exuberance. Social contagion and herd behavior were evident as seeing neighbors get rich quickly was often too tempting to resist. Both bubbles were inflated by a swirl of half-truths, rumors, and outright lies. Regulatory and institutional failures were clear in both cases, with safeguards that were woefully lacking or ineffective. These patterns, surprisingly consistent through time, highlight the psychological underpinnings of market behavior, revealing that human nature can be as cyclical as the markets themselves.

Comparisons and Contrasts

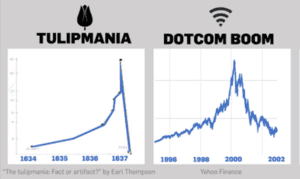

Both episodes involve rampant speculation on seemingly arbitrary commodities, but their contexts and scales differed significantly. From the Dot-com Bubble to the Housing Crisis of 2008, we see striking parallels in more recent history, raising questions about how these episodes compare to modern financial bubbles. These tales, though separated by centuries and context, weave a common narrative of ambition, societal pressure, and the perilous nature of unchecked speculation.

Lessons Learned

Both crises led to major changes in financial regulations in an effort to prevent future madness. While both the Dutch and British economies suffered in the short term, they proved resilient over time. Today, economists and policymakers study these episodes as cautionary tales that continue to inform future thinking on economics and finance. They are constant reminders that, in the absence of diligent oversight and prudent behavior, history is not only instructive but potentially prophetic.

Contemporary Parallels

The crypto frenzy and meme stocks of 2021 have shown that in the age of the internet, bubbles can form and burst faster than ever. This recent history forces us to ask a critical question continuously: Are we doomed to repeat the past, or can we learn to spot a bubble before it bursts? As we navigate an ever-evolving financial landscape, these historical lessons could prove invaluable, serving as a guide for individual investors and policymakers alike.

Conclusion

The South Sea Crash and Tulip Mania are more than just historical events; they are enduring tales of human nature, greed, and the collective behavior of markets. These stories are etched into the financial consciousness and serve as stark reminders of the potential pitfalls in speculative ventures. In the next installment, “The Madness of Crowds Part II,” we will venture into more recent territory, examining the bubbles of the 20th and 21st centuries.

If you have any questions, give us a call.

Have a great weekend!

Source: Ballentine Capital Advisors

Golf Tip of the Week

The 5 Most Eye-Opening Takeaways From The Final 2022-23 PGA Tour Money List

It was once the standard that largely determined whether PGA Tour pros kept or lost their playing privileges for the following year. These days, however, the end-of-the-season money list exists so far in the shadow of the FedEx Cup, you’re hard pressed to find it on the tour’s website. As the 2022-23 edition became official upon the conclusion of last week’s BMW Championship (the $75 million on the line at the Tour Championship is technically not prize money but rather FedEx Cup bonus dollars).

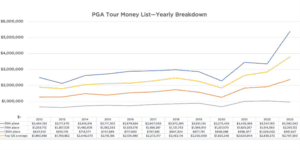

A look at the numbers motivated us to take the extra step of compiling data for the past 10 years, along with snapshots from 2003, 1993 and 1983. Comparing all the crazy cash provides a fascinating picture of how things have changed over the years—and really changed the last few seasons. Here are a few things that caught our eye.

Scottie Scheffler just won a lot of money

Scheffler, who never finished outside the top 11 in a single tournament before the Open Championship, was insanely good this year, and his outrageous skill earned him a figure that is almost garish: $21 million and change to top this year’s list. For context, prior to 2022, just one player had ever earned more than $10 million in a single season, and that was Jordan Spieth in his wonder year of 2015. Then in 2021-22, Scheffler broke every record by earning $14 million. Now he has lapped himself, and if he can pull out the FedEx Cup title this week, he’ll claim another $18 million.

Mind you, this is about more than just success; the total money available to players this season on the PGA Tour exceeded $500 million for the first time, an increase of about $140 million last year alone. Scheffler was one of seven tour pros to earn eight figures this season (Jon Rahm was second on this year’s money list with $16 million in earnings). So Scheffler’s haul is a combination of great play and a rising tide.

That rising tide is raising most ships

Among the top 125 on the PGA Tour money list in 2023, the average earnings were $3.79 million, an increase of almost a million dollars from 2022’s $2.84 million. If you look at specific positions on the money list, too, Si Woo Kim’s 30th-place haul of $5.38 million is a jump of $2.5 million from K.H. Lee’s 30th-place money in 2022; Sam Ryder in 70th ($2.36 million) beat Matt Jones’ 70th total ($1.91 million); and you have to go down to 125th before you find that Nico Echavarria’s $951,000 just fell short of Charles Howell III’s figure of $1.03 million last year. In all, the only thing that stayed relatively steady was the number of players making at least a million dollars. After a big jump in 2021 from 112 to 124 (not counting the shortened COVID year of 2020), it went up to 126 last year, and back to 124 in 2023.

The rich are definitely getting richer

To the tour’s credit, the emphasis on designated events and increasing top prizes didn’t materially affect the earnings of the players lower on the list, although it’s also a fact that the lion’s share of the gains went to the top players. To some extent, that’s again because of great results; Scheffler making 172 percent more than 2021 top finisher Jon Rahm isn’t just about higher purses. But incrementally the higher positions on the money list saw bigger gains, at No. 30, Si Woo Kim saw a 60-percent increase; Ryder saw a 21-percent increase at No. 70, and once you got down to No. 125, there was actually a decrease in earnings. Even when you look at 2013, the amount made by the 125th player, Kevin Chappell, wasn’t that far behind today’s 125 at $647,000. One of the main points of the changes implemented this year was to funnel dollars to the best players, in a model that’s more representative of their worth to the tour, and that very much came to pass.

The prize increases at the top are outpacing inflation by a whole lot

In 1983, Hal Sutton was the top earner on tour, taking home $426,000. According to the Bureau of Labor Statistics, that would be about $1.38 million today … a sizable increase, but nowhere near the reality of Scheffler’s $21 million haul. You don’t have to look at a 40-year gap, either; Tiger Woods’ total of $8.5 million in 2013 would be worth about $11 million today. Again, not very close. It’s happening at the bottom, too; the tour average for players in the top 125 of $116,000 in 1983 would only be worth $360,000 today, not the $3.8 million tour pros averaged in 2022-23. Golf has become a far richer sport for its top athletes.

This is almost definitely the new normal

This is just simple math; a big part of the changes this year were a result of the tour trying to compete with LIV Golf. If for whatever reason the merger doesn’t go through, they’re still going to have to compete with LIV Golf, and if it does go through, they’ll have the assets of the PIF at their disposal. There’s no scenario barring some kind of economic depression in which this very expensive toothpaste goes back in the tube. If anything, you’d expect it to go up.

Tip adapted from golfdigest.comi

Recipe of the Week

Frozen Sangarita

4 Servings

Ingredients

- 4 cups ice

- 1/2 cup tequila

- 1/4 cup orange liqueur, such as Grand Marnier or Cointreau

- 1/4 cup fresh lime juice (about 4 limes)

- 1 tablespoon agave

Instructions

- For the frozen margarita: Add to a blender the ice, tequila, orange liquor, lime juice and agave. Blend until combined, adding more ice to make thicker. Remove to a pitcher.

- For the frozen sangria: Add to a blender the ice, red wine, orange juice, lemon juice and agave. Blend until combined, adding more ice to make thicker. Remove to a pitcher.

- To serve: Spoon a layer of frozen margarita and then a layer of frozen sangria into a margarita glass and repeat to create layers. Best served with straws!

Recipe adapted from Foodnetwork.comii

Health Tip of the Week

Beat Germs All Over Your House

Start in Your Laundry Room

Think your washing machine is one of the cleanest places in your house? Think again. Dirty laundry can fill your washer — and future loads of laundry — with bacteria and viruses. To keep it fresh, run your washer empty with a cup of bleach once a week. To kill germs, wash and dry your laundry at the highest temperature the fabric can stand.

Really Clean Your Towels

- If only one person is using a towel, wash it once a week. Wash after each use if someone is sick.

- Wash gym towels after each workout.

- Wash kitchen towels separately from underwear and bathroom towels.

- Replace hand towels every few days, or every time you have guests.

- Hang towels to air dry. Don’t reuse any in a heap on the floor.

Banish Bedroom Germs

- Wash all bed linens at least once a week in hot water — more often if someone is sick.

- Wash soiled items — like clothes with grass stains — separately from other laundry, especially sheets.

- Keep food and snacks out of bedrooms. Crumbs attract mold and bacteria.

Sanitize Your Family Room

Germs hang out where you do — especially spots everyone touches like telephones, coffee tables, TV remotes, and video controllers. Clean them often with disinfectant wipes. Use a damp microfiber cloth to gently wipe dust from your flat screen TV. Vacuum crumbs and clean spills right away, so bacteria doesn’t grow in your carpets and furniture.

Clean Knobs and Railings

Germs spread quickly on doorknobs, cabinet handles, railings, faucets, light switches, and lamps. Sanitize these surfaces once a week with disinfecting wipes or a disinfecting cleaner. Do it more often if someone in your family is sick or if you have guests. This will help kill viruses like COVID-19 and the flu.

Wipe Down the Office

Computer keyboards, desktops, and telephones are breeding grounds for germs, especially if you share equipment or eat while you work. Shake out your keyboard often, or use a vacuum attachment to remove junk. Then use a wipe to disinfect it. Or, get a skin for your computer keyboard and don’t forget to wash it. Wipe your computer screen with a damp microfiber cloth.

Disinfect Kids’ Rooms

Kids get and spread germs easily. Once a week, wipe down all surfaces in your child’s room with disinfecting wipes or spray. If you have a baby, be sure to really clean the diaper changing area, crib rails and slats, and plastic toys. Leave the disinfectant on for at least 30 seconds and then wipe well with moist paper towels or a clean, wet cloth.

Sanitize the Kitchen Sink

Forget the bathroom. The kitchen sink is the second germiest place in the house. The kitchen sponge is No. 1. Bacteria from raw meats and other foods flourish and grow in your sink. Scrub it with a disinfecting cleanser every day. And that sponge? Wet it and zap it in the microwave for two minutes each day to help kill any E. coli and salmonella lurking there.

Keep Countertops Clean

Clean your kitchen counters every day after you prepare food. First, wash them with hot soapy water to get rid of any gunk and grime you can see. Then use a solution of 1/2 cup of bleach in 1 gallon of water (or whatever is recommended for your countertops) to sanitize them. Let them air dry. To help keep your counters germ-free, don’t put your purse, laptop, phone, mail, or anything else on top of them.

Tackle the Fridge

Keep your fridge clean by washing the inside walls, doors, and shelves with hot soapy water every few months. To get rid of smells, use a mix of half water and half white vinegar. Or, wash with a mixture of baking soda and water, then let the fridge air out for a few hours. Always clean up refrigerator spills right away.

Scour the Bathroom

Make an all-purpose bathroom cleaner by mixing two tablespoons of dish liquid, two tablespoons ammonia, and one quart of warm water. Use this for the tub, sink, floors, and shower. Rinse with clean water. A baking soda paste can help get rid of marks in the sink or tub. Using a squeegee on shower walls after each shower helps stop mold and mildew from growing.

Put a Lid on Toilet Germs

Leaving the lid up when you flush can spread fecal matter and germs all over your bathroom, even to your toothbrush. To limit nasty germs, clean your toilet bowl weekly — and keep the lid down. Use a wet cloth and an all-purpose cleaner to wash the lid, seat, and outside of the bowl. Then use a toilet brush and the cleaner to scrub inside the bowl.

Make Your Own “Greener” Cleaner

Diluted bleach is best for disinfecting against germs. But for everyday cleaning, you can’t beat white distilled vinegar. Mix one part white vinegar and nine parts water in a spray bottle or bucket. It will safely clean most surfaces and remove grease. Plus, it’s safe to use around kids and pets.

Don’t Forget Hallways and Carpets

When you walk through your house wearing shoes, you’re tracking in everything you’ve stepped on outside, including E. coli and other bacteria that can cause illness. For the cleanest floors and carpets, and the least mess, leave your shoes at the door. If you do wear shoes inside, vacuum carpets and wash floors once a week.

Tip adapted from WebMD.comiii

Copyright (C) 2021. Ballentine Capital Advisors. All rights reserved.

Our mailing address is:

Ballentine Capital Advisors

15 Halton Green Way

Greenville, SC 29607

unsubscribe from this list update subscription preferences

Disclosure:

Ballentine Capital Advisors is a registered investment adviser. The advisory services of Ballentine Capital Advisors are not made available in any jurisdiction in which Ballentine Capital Advisors is not registered or is otherwise exempt from registration.

Please review Ballentine Capital Advisors Disclosure Brochure for a complete explanation of fees. Investing involves risks. Investments are not guaranteed and may lose value.

This material is prepared by Ballentine Capital Advisors for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation or any particular security, strategy, or investment product.

No representation is being made that any account will or is likely to achieve future profits or losses similar to those shown. You should not assume that investment decisions we make in the future will be profitable or equal the investment performance of the past. Past performance does not indicate future results.

Advisory services through Ballentine Capital Advisors, Inc.

i https://www.golfdigest.com/story/final-2022-23-pga-tour-money-list-most-eye-opening-takeaways

ii https://www.foodnetwork.com/recipes/trisha-yearwood/frozen-sangarita-recipe-2090092

iii https://www.webmd.com/parenting/ss/slideshow-clean-up-germs