Investing can often feel like riding a roller coaster—thrilling highs followed by sudden, unexpected drops. Market swings are a natural part of the journey, but they can still leave investors feeling uneasy. In times of volatility, staying grounded with a few key reminders can help put short-term movements into long-term perspective. Here are some strategies to help you stay focused on the long-term:

1. Keep Your Eye on the Horizon

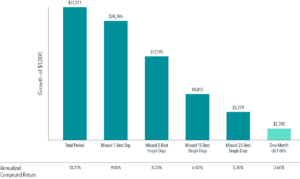

When you invest, you can expect that both ups and downs will be part of the ride. Decades of stock market returns demonstrate how often declines can happen. For evidence, look at the largest intrayear declines for the US stock market in every year from 1979 to 2023. Those declines average to -14%. However, 37 of the past 45 calendar years have ended with positive returns for the US stock market (see Exhibit 1). So instead of getting anxious over a near-term drop, keeping an eye on the horizon can help investors keep the queasiness at bay.

Exhibit 1

US Market Intrayear Gains and Declines vs. Calendar Year Returns

1979–2023

2. Stay in Your Seat

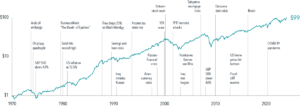

When the stock market drops precipitously, or headlines speculate it might, it can be tempting to jump out of the market to try to avoid (further) losses. But just as roller-coaster riders are warned to keep their seat belts fastened and stay seated, investors may be well advised to do the same.

Attempting to time the market to avoid the worst days could cause an investor to miss out on some of the best days (see Exhibit 2). Consider that $1,000 invested in the S&P 500 Index back in 1990 would have grown to $27,221 by the end of 2023 if left untouched. However, if an investor had pulled their money out and missed the single best day over the more than 30-year period, their ending wealth would be reduced by nearly $3,000. Worse, if an investor had missed the five best single days, their ending wealth would be reduced by more than $10,000. Over the course of decades, even a few days can make a big difference.

Exhibit 2

S&P 500 Index Performance Based on Time in the Market

1990–2023

Taking a step back from the current moment may provide investors helpful perspective and put fears at ease. Markets have marched upward through the decades, even amid concerning world events, and rewarded disciplined investors over time (see Exhibit 3). This reminds investors that, despite the extreme headlines and bumps experienced in the short term, you may have a better ride by staying in your seat.

Exhibit 3

Growth of a Dollar—MSCI World Index (Net Dividends)

1970–2023

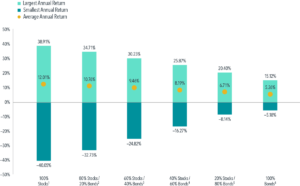

3. Know Your Thrill Tolerance

The same way theme-park goers can choose rides that align with their thrill tolerance, investors can choose an asset allocation that aligns with their risk tolerance. Financial advisors can play a key role in helping you do just that—by exploring your investment objectives and time horizons, and helping you build a diversified portfolio with the appropriate level of resilience (see Exhibit 4).

Exhibit 4

Stock-Bond Asset Allocation Performance

1985–2023

Investing doesn’t have to be a harrowing, white-knuckle experience. A few simple reminders and the help of an investment professional can give you the confidence to ride out the rough patches.

Footnotes

- The Dimensional Core Market 100/0 Index Allocation combines the following indices: Dimensional US Core Equity Market Index, Dimensional International Core Equity Market Index, Dimensional Emerging Markets Core Equity Market Index, and the S&P Global REIT Index (gross dividends).

- 80% of the weight is allocated to the Dimensional Core Market 100/0 Index Allocation, and 20% of the weight is allocated to the following indices: Dimensional Short-Term Extended Quality Index (10%) and Dimensional US Core Fixed Income Index (10%).

- 60% of the weight is allocated to the Dimensional Core Market 100/0 Index Allocation, and 40% of the weight is allocated to the following fixed income indices: Dimensional Short-Term Extended Quality Index (25%) and Dimensional US Core Fixed Income Index (15%).

- 40% of the weight is allocated to the Dimensional Core Market 100/0 Index Allocation, and 60% of the weight is allocated to the following indices: Dimensional Short-Term Extended Quality Index (40%) and Dimensional US Core Fixed Income Index (20%).

- 20% of the weight is allocated to the Dimensional Core Market 100/0 Index Allocation, and 80% of the weight is allocated to the following indices: Bloomberg US TIPS Index (10%), Dimensional US Ultra-Short Fixed Income Index (10%), Dimensional Short-Term Extended Quality Index (50%), and Dimensional US Core Fixed Income Index (10%).

- The Dimensional Core Market 0/100 Index Allocation combines the following indices: Bloomberg US TIPS Index (20%), Dimensional US Ultra Short Fixed Income Index (20%), and Dimensional Short-Term Extended Quality Index (60%).

Disclosures

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

UNITED STATES

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.

Source: DFA Investing Can Be A Roller Coaster: Three Tips for Riding Out the Ups and Downs

Copyright © 2025. Ballentine Capital Advisors. All rights reserved.

Our mailing address is:

Ballentine Capital Advisors

15 Halton Green Way

Greenville, SC 29607

Disclosure:

Ballentine Capital Advisors is a registered investment adviser. The advisory services of Ballentine Capital Advisors are not made available in any jurisdiction in which Ballentine Capital Advisors is not registered or is otherwise exempt from registration.

Please review Ballentine Capital Advisors Disclosure Brochure for a complete explanation of fees. Investing involves risks. Investments are not guaranteed and may lose value.

This material is prepared by Ballentine Capital Advisors for informational purposes only. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation or any particular security, strategy, or investment product.

No representation is being made that any account will or is likely to achieve future profits or losses similar to those shown. You should not assume that investment decisions we make in the future will be profitable or equal the investment performance of the past. Past performance does not indicate future results.